- 분석

- 기술적 분석

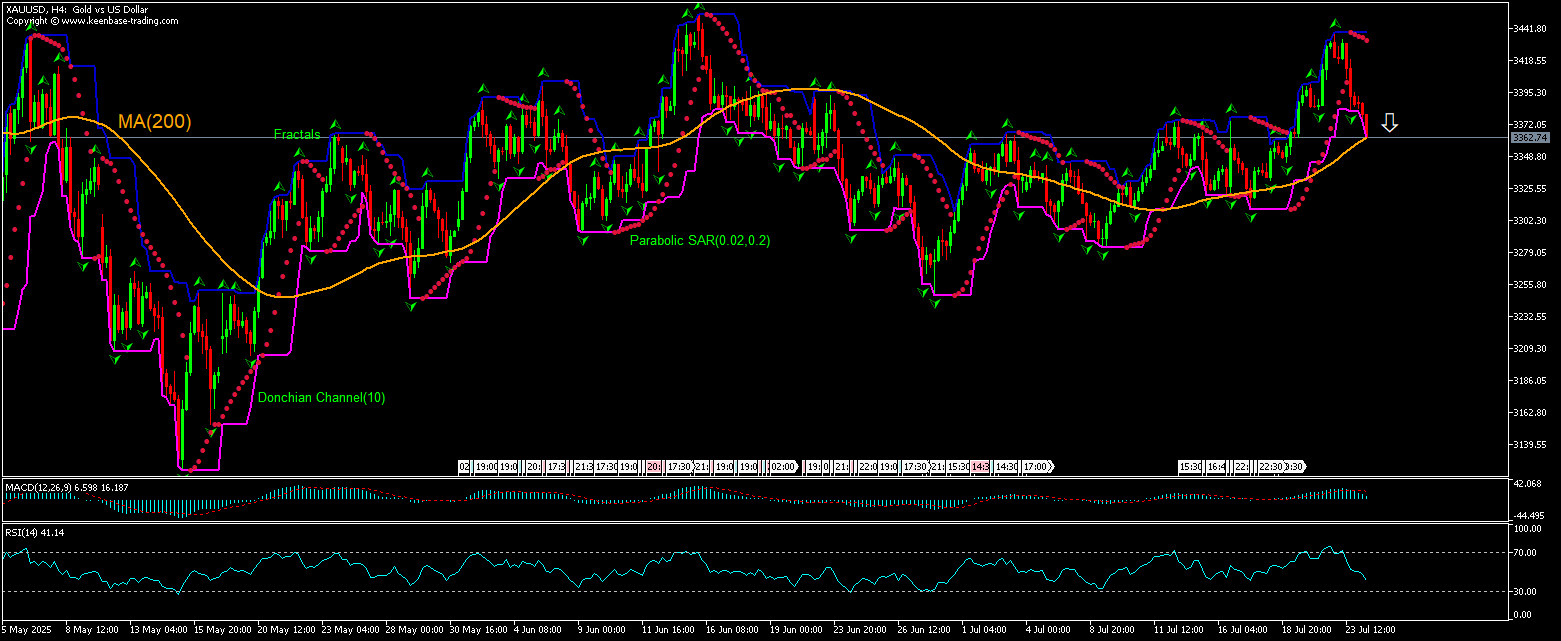

Gold 기술적 분석 - Gold 거래: 2025-07-24

Gold 기술적 분석 요약

위에 3374.23

Buy Stop

아래에 3402.45

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 판매 |

| Donchian Channel | 판매 |

| MA(200) | 구매 |

| Fractals | 중립적 |

| Parabolic SAR | 판매 |

Gold 차트 분석

Gold 기술적 분석

The technical analysis of XAUUSD price on the 4-hour timeframe shows XAUUSD,H4 is testing the 200-period moving average MA(200) as it retraced down after hitting 5-week high yesterday. We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 3362.43. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 3402.45. After placing the pending order the stop loss is to be moved every day to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3402.45) without reaching the order (3362.43) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

귀금속 - Gold 기본 분석

Central banks and sovereign wealth funds continued to actively buy gold in the first half of this year. Will the XAUUSD resume advancing?

World Gold Council reported five top buyers of gold in the first half of 2025 added 148.7 tonnes of the precious metal to their holdings of the haven asset. Poland leads the list of top gold buyers as it increased its official reserves by 67.2 tonnes as of May. The State Oil Fund of the Republic of Azerbaijan is the second largest gold buyer with total H1 net purchases of 35 tonnes and total gold holdings of 181 tonnes - almost 29% of its total portfolio. People’s Bank of China occupies the third spot in the list of top gold buyers in 2025 with purchases in the first half of the year totaling 16.9 tonnes as of May. Next come the Central Bank of the Republic of Turkey and Kazakhstan, which bought 14.9 and 14.7 tonnes of gold respectively in the first half of the year. And surveys released last month indicate that central banks are expected to add to their gold reserves over the next 12 months. Continuing active purchases of hold by central banks and sovereign funds is bullish for XAUUSD price. However, the current setup is bearish for gold.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.